Commercial Unit Tutorial

This will walk you through how to set up a property that has a commercial unit in addition to residential units.

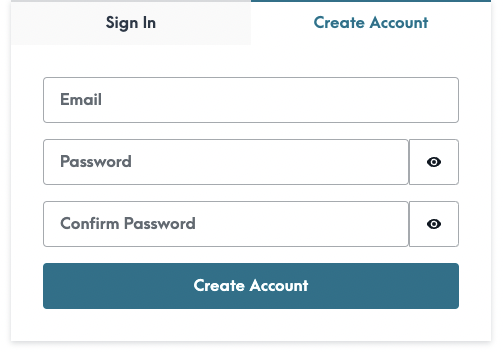

The first step is creating an account via the Log In/Sign Up button at the top right of the page. From there you will see this site, where you will enter an email address and password to set up your account.

You can choose any email address you like, if you need to transfer to another board member or property manager in the future there is an easy transfer process allowing you to do so.

It takes a few seconds to load so don’t worry about the spinning circle!

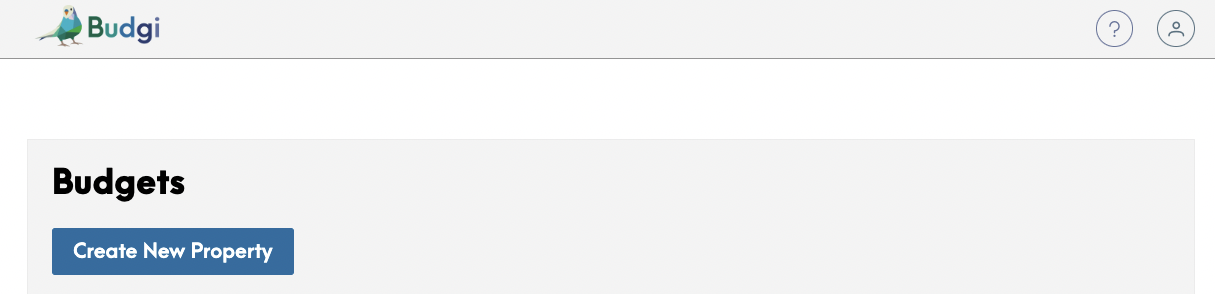

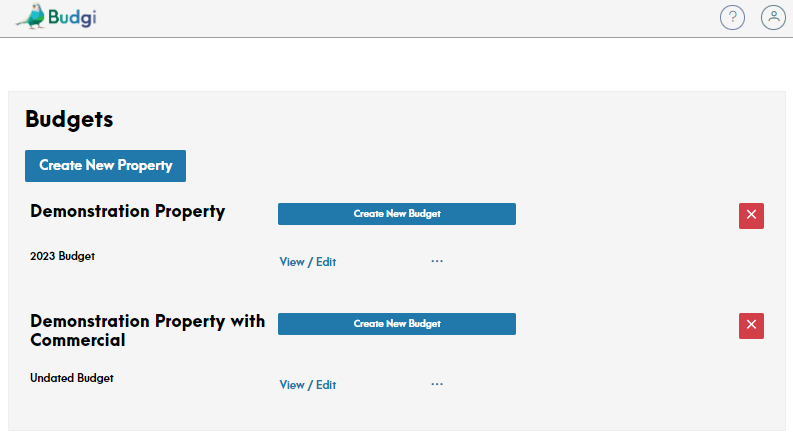

Once you’ve created your account you’ll have to Create a New Property.

Then for that property you’ll be able to Create a New Budget.

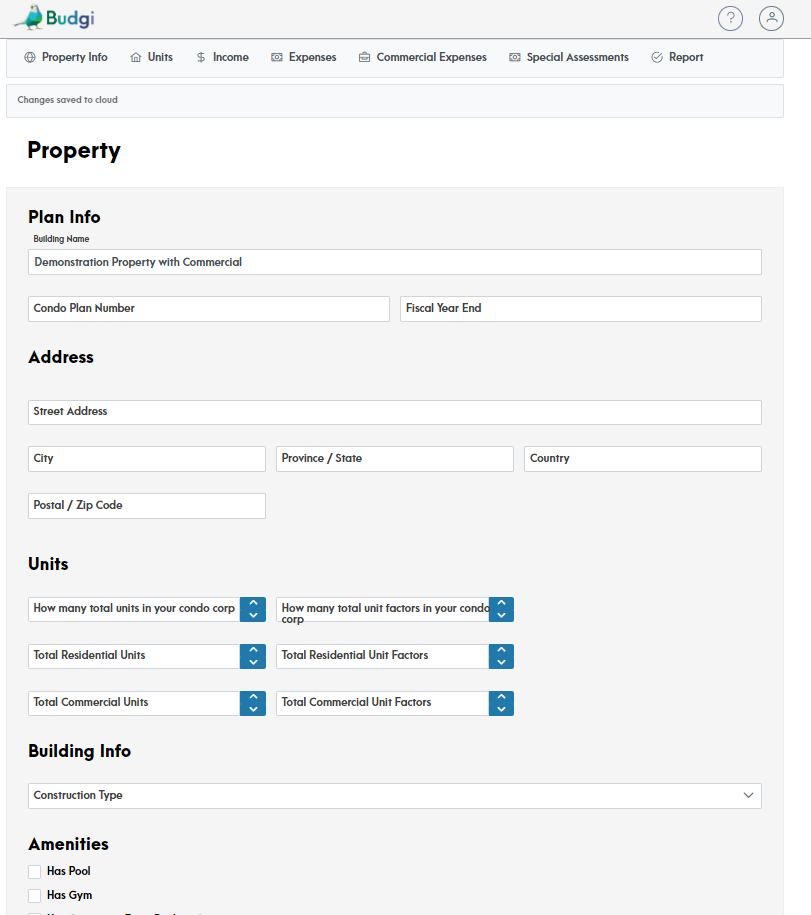

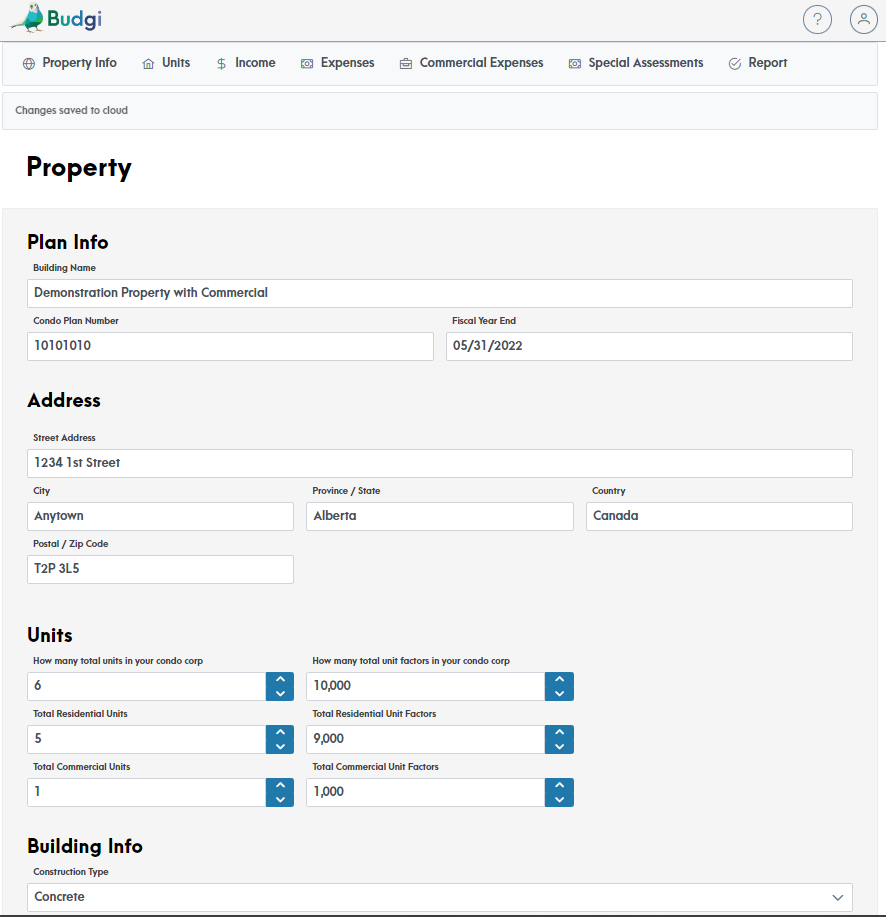

This will bring you to the Property Info page within the Budgi dashboard.

Fill out all the fields with the appropriate information. Total Building Units is the total of Residential Units (suites/condos etc) plus the number of Commercial Units. Ensure that the Commercial plus Residential add up to the total! As for the construction type, pool, gym, concierge info that’s Budgi asking for some data to help us get to know our users.

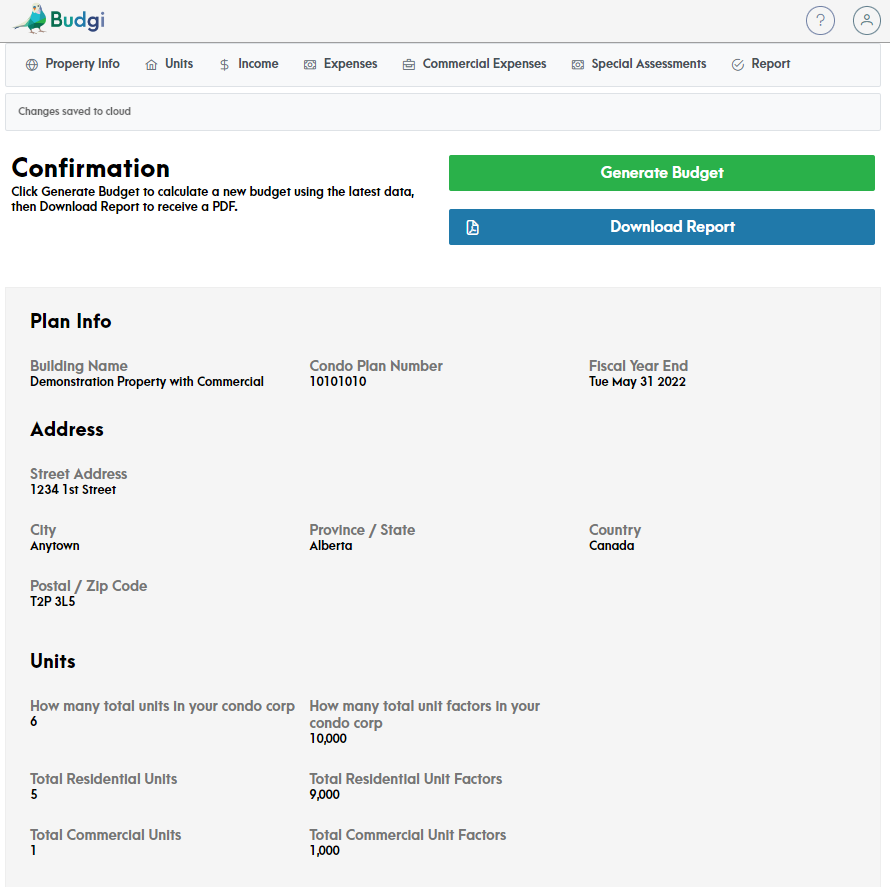

This is an example of how a building with 5 Residential Units and 1 Commercial Unit should fill in their form (assuming the norm for Alberta of 10,000 unit factors is applied, your property may be different so please refer to your plan).

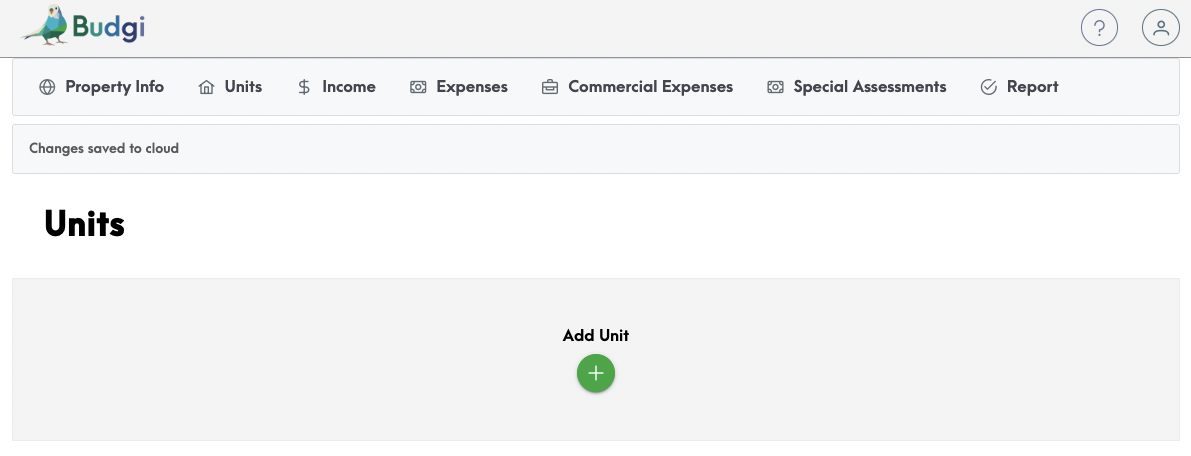

Once this page is filled in click on the Units tab at the top of the Dashboard then start adding units

Use the unit factor data from your condominium plan or similar document to fill in the appropriate information for all of the units in your property, and select whether it is a Residential or Commercial Unit.

Legal Unit ID: This is what an owner’s unit would be referred to on their title document and in the plan for the property filed with the registry.

Name: This is unit number that forms a part of the civic/mailing address for the unit. For example: XXXX - 1234 1st Street, Anytown, Canada. You would enter the XXXX number here.

Unit Factor: This is the number of unit factors this unit has, as noted in the plan. It determines what amount of fees this unit owners pays each month or towards a special assessment.

Unit Type: Select whether this unit is a Residential or Commercial property so that the proper formula is applied to determine their fees if there is a differentiation between the two owner types in fee calculation.

Ensure that you have entered all this data carefully, report generation will show a BAD DATA error if the numbers entered here do not add up the unit factors entered in the Property Info page.

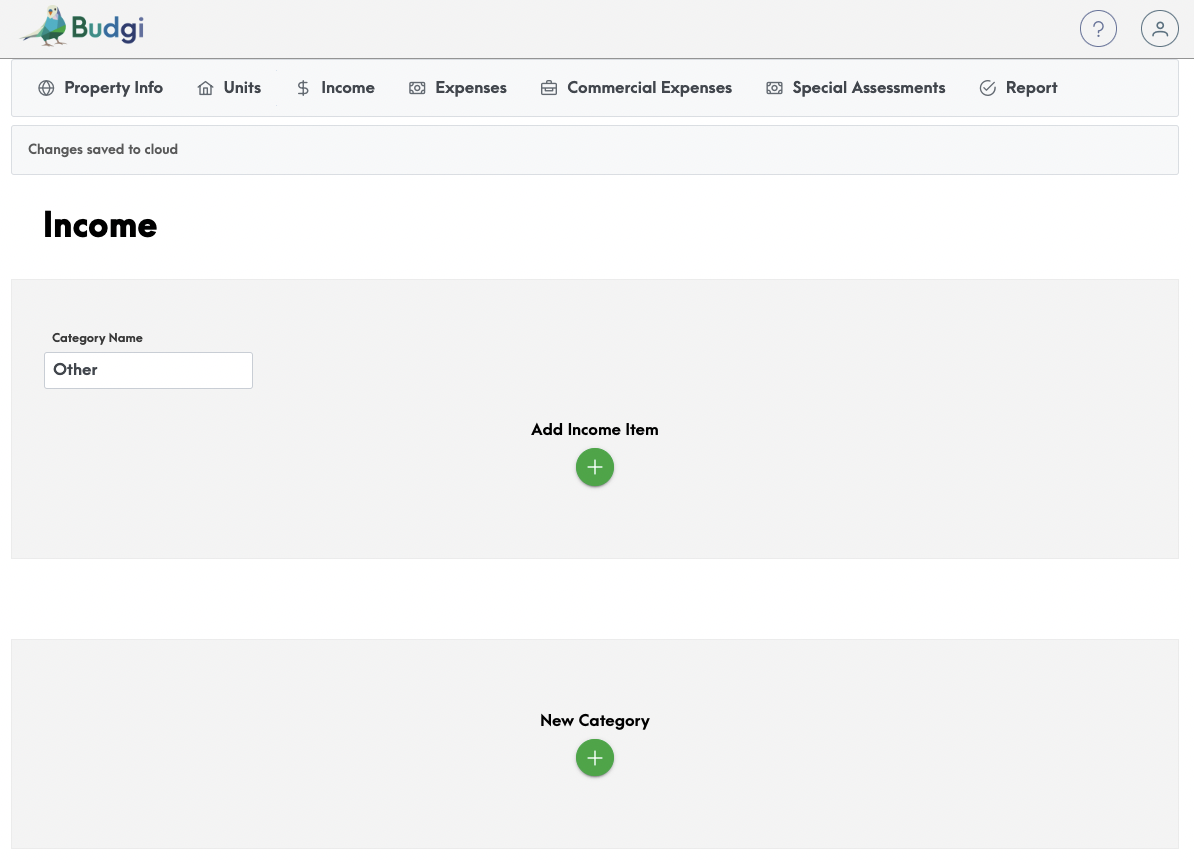

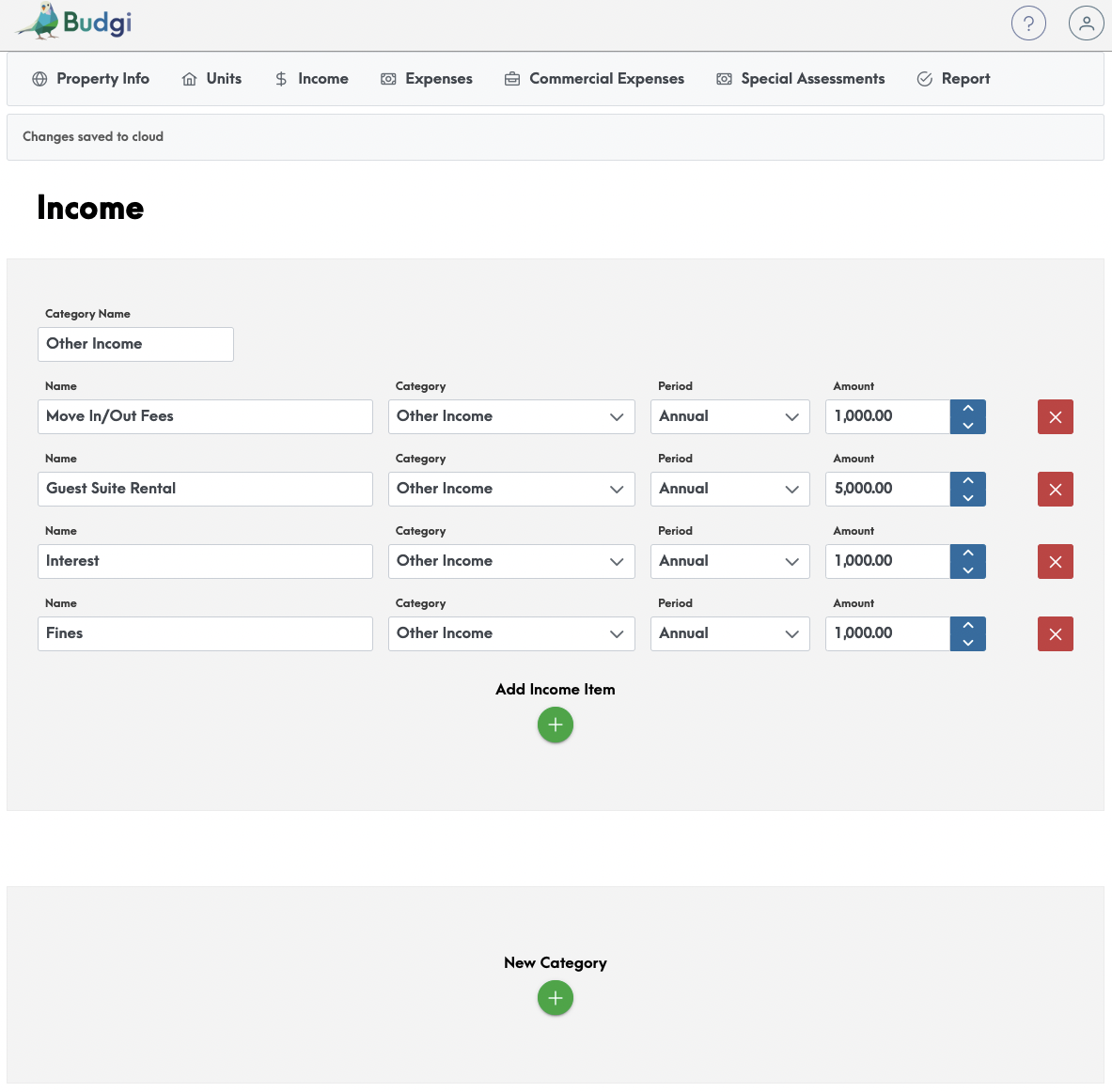

The Income tab is where you will enter the revenues that your property collects other than the fees that are determined by your expenses. For example you may collect move in/out fees, key replacement, guest suite rental, fines or interest. You can create multiple categories if there are wide ranging income items, or simply name the one category “Other Income” and note the sub-items. If you budget for no other income besides condo fees, just keep it blank and it will not be included in your report.

Once you’ve filled in your income items that are in addition to the condo fees collected, select the “Expenses” tab. There are a few pre-populated categories, if they are not applicable just delete the text, or rename and re-order however you prefer.

Input your expense items and select whether they are monthly or annual. Each item has the ability to categorize it as a Reserve Fund Transfer, but generally there is only one line item that will require this to be checked as yes, so remember to do so when you enter this (most buildings have a reserve fund they transfer a budgeted amount of funds from their income to, yet some may not).

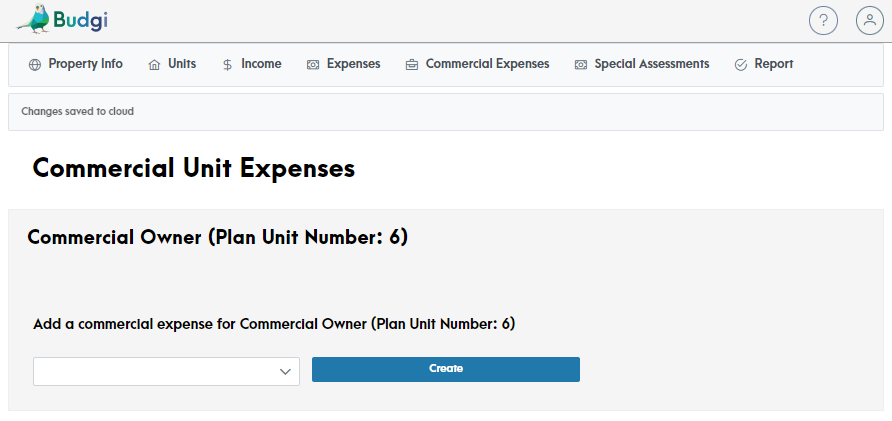

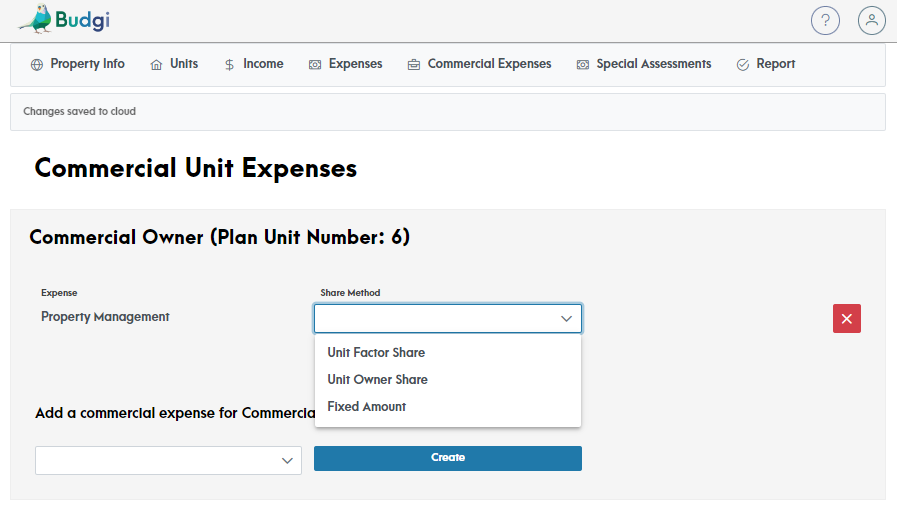

Once your expense items, it is time to select which ones are shared by the Commercial Owner. This allows for circumstances where the Commercial Owner may participate in only a selection of expenses, and if so, may share based on unit factor or unit number calculation. For instance, they may 1,000/10,000 share in an expense based on the entries made in this demonstration for a unit factor share, or 1/6 share based on a unit number basis.

This section is where you select which expenses the Commercial Owner shares in, and by what calculation. If the unit factor and unit number calculations do not apply to your situation, you can enter a fixed fee if that serves your needs or a different calculation is applicable that you can conduct outside of the app.

Note that the drop down allows for calculation selection for the Commercial Owner share.

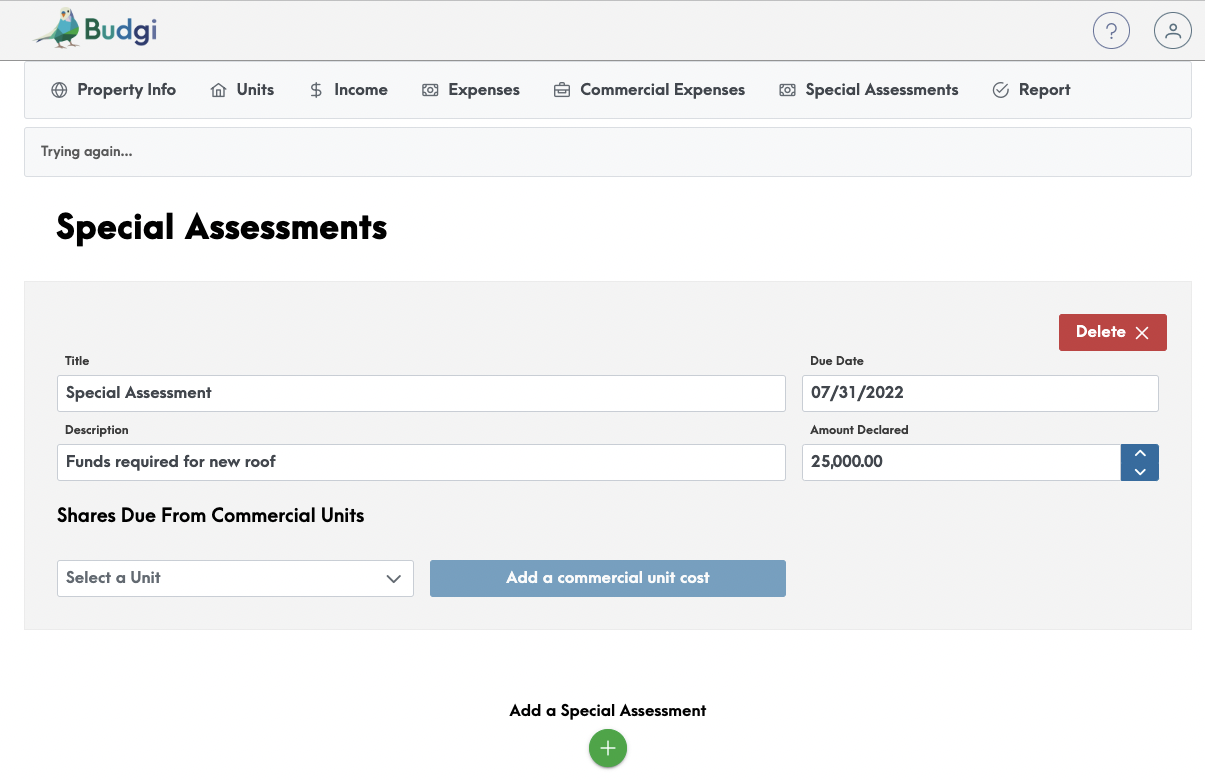

Once you’ve entered all your expense items for you can add a special assessment if you have accounted for one in the coming fiscal year. You can also select what sharing calculation is applicable for the Commercial Owner.

Please review the parameters of your jurisdiction as to what types of expenses can be attributed towards the income received from a special assessment. Once you have confirmation that this item is an appropriate charge for your budget, enter the Title as it should appear in the budget, a description, the due date and the amount declared.

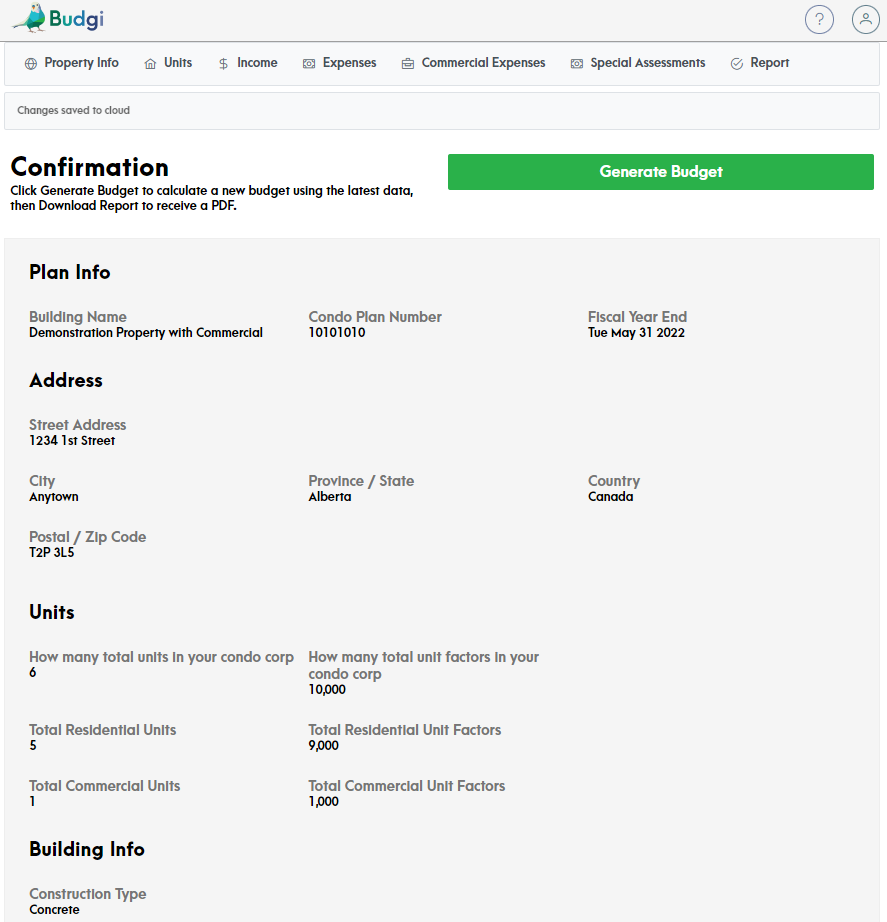

Now you’re ready to generate your report which will include your budget, monthly fee per unit and share per unit of any special assessments. Payment of $3/door is required prior to report generation, if there are any errors you notice or changes required after the fact you can always go back and change them without additional charges. Simply enter your credit card number, expiry date, CVC number and the postal/zip code associated with your billing address. If the “Generate Budget” button isn’t bright green, just refresh the screen or log out and re log in and go to report as your session may have timed out. Don’t worry all your data entries will still be there! Once you’ve got the bright green “Generate Budget” button, click on it, to see all your budget items.

If everything looks correct click on download report and a PDF file of your budget, monthly fees per unit, commercial fees and special assessment per unit. If any of the items are incorrect you can always go back, correct the entry error and then click on Generate Budget and Download Report again to confirm everything has been corrected.

Your budget will be stored and you can simply duplicate it for next year!